The Pillar Two framework, as adopted in the UAE through the Domestic Minimum Top-Up Tax (DMTT) regime, employs a two-step mechanism to determine whether a group falls within scope. The first step is to assesses whether the group qualifies as a Multinational Enterprise (MNE) Group. The second step considers size, applying a consolidated revenue threshold across a four-year lookback period.

This case study examines the hierarchy and interaction between these two thresholds. Specifically, it raises the question: if a group no longer meets the MNE definition in the tested year, but exceeded the EUR 750 million revenue threshold in prior years during which it had foreign presence, does the DMTT still apply? We explore this issue through the example of a UAE-headquartered company that discontinues its only foreign permanent establishment prior to the tested year.

Facts

A company incorporated in the UAE operates without any group affiliation and is wholly owned by individuals. In prior years (2022 and 2023), its global revenue did not exceed EUR 750 million. However, in both 2024 and 2025, this threshold was exceeded.

The company previously maintained a branch in India, which is treated as a permanent establishment (PE) under Kazakh law and under the UAE–Kazakhstan double tax treaty. The branch is scheduled to be closed in 2025, and the company will not maintain any other subsidiaries or foreign permanent establishments as of 1 January 2026.

This factual setting raises a core question of whether the company would fall within the scope of the Domestic Minimum Top-Up Tax (DMTT) regime in the UAE in 2026, given that:

- The group meets the revenue threshold in 2024 and 2025;

- The foreign PE will have ceased to exist in 2026.

Question

Will the company be subject to the UAE DMTT in the fiscal year 2026?

Summary

Upon the analysis below, we concluded that the Company will not be subject to DMTT in 2026, as:

- It will not qualify as a Constituent Entity of an MNE Group in that year;

- The Revenue Threshold Test becomes irrelevant if the MNE Group status is not met in the tested fiscal year.

Analysis

According to Article 1.2.1 of the UAE DMTT Rules, an MNE Group is defined as “an MNE Group means any Group that includes at least one Entity or Permanent Establishment that is not located in the Jurisdiction in which the Ultimate Parent Entity of the MNE Group is located”.

Accordingly, for DMTT purposes, it is first necessary to determine whether the Kazakh branch is a permanent establishment (PE).

Article 18.1 of the DMTT Rules defines a PE as “a place of business (including a deemed place of business) situated in a Jurisdiction and treated as a permanent establishment in accordance with an applicable Tax Treaty in force provided that such Jurisdiction taxes the income attributable to it in accordance with a provision similar to Article 7 of the OECD Model Tax Convention on Income and on Capital”.

Hence, to determine whether a PE exists, one must examine both the presence of a UAE–Kazakhstan double tax treaty (DTT) and the relevant provisions of that treaty.

Article 5(2)(b) of the UAE–Kazakhstan DTT includes a “branch” within the definition of a PE. However, Article 5(4) of the same treaty excludes from the scope of PE certain activities that are of a preparatory or auxiliary character.

Therefore, the Kazakh branch will give rise to an MNE Group only if its activities exceed the preparatory or auxiliary threshold and it is treated as a PE under the treaty. If the branch does not constitute a PE, no MNE Group exists.

For the purpose of this analysis, we assume that the branch’s activity constitutes a PE under the UAE–Kazakhstan DTT.

Article 1.1.1 of the DMTT Rules provides: “this Decision shall apply to Constituent Entities that are members of an MNE Group that has annual revenue of EUR 750 million or more in the Consolidated Financial Statements of the Ultimate Parent Entity in at least two of the four Fiscal Years immediately preceding the tested Fiscal Year. Further rules are set out in Article 6.1 which modify the application of the consolidated revenue threshold in certain cases”.

Further clarification is provided in paragraph 17 of the Consolidated Commentary to Article 1 of the GloBE Model Rules,[1] which states: “Article 1.2 defines the terms ‘MNE Group’ and ‘Group’ for the purposes of the GloBE Rules… These terms… restrict the GloBE Rules to those Groups or Entities with foreign subsidiaries or branches”.

Paragraph 18 reinforces this by explaining that: “As described in the Commentary on Article 1.1, the Constituent Entities of a Group will not be subject to the GloBE Rules unless they are members of an MNE Group. Article 1.2.1 sets out the definition of an MNE Group. There are two elements to this definition: … b. A Group will be an MNE Group if it has one or more Entities or PEs located in a jurisdiction other than the UPE jurisdiction”.

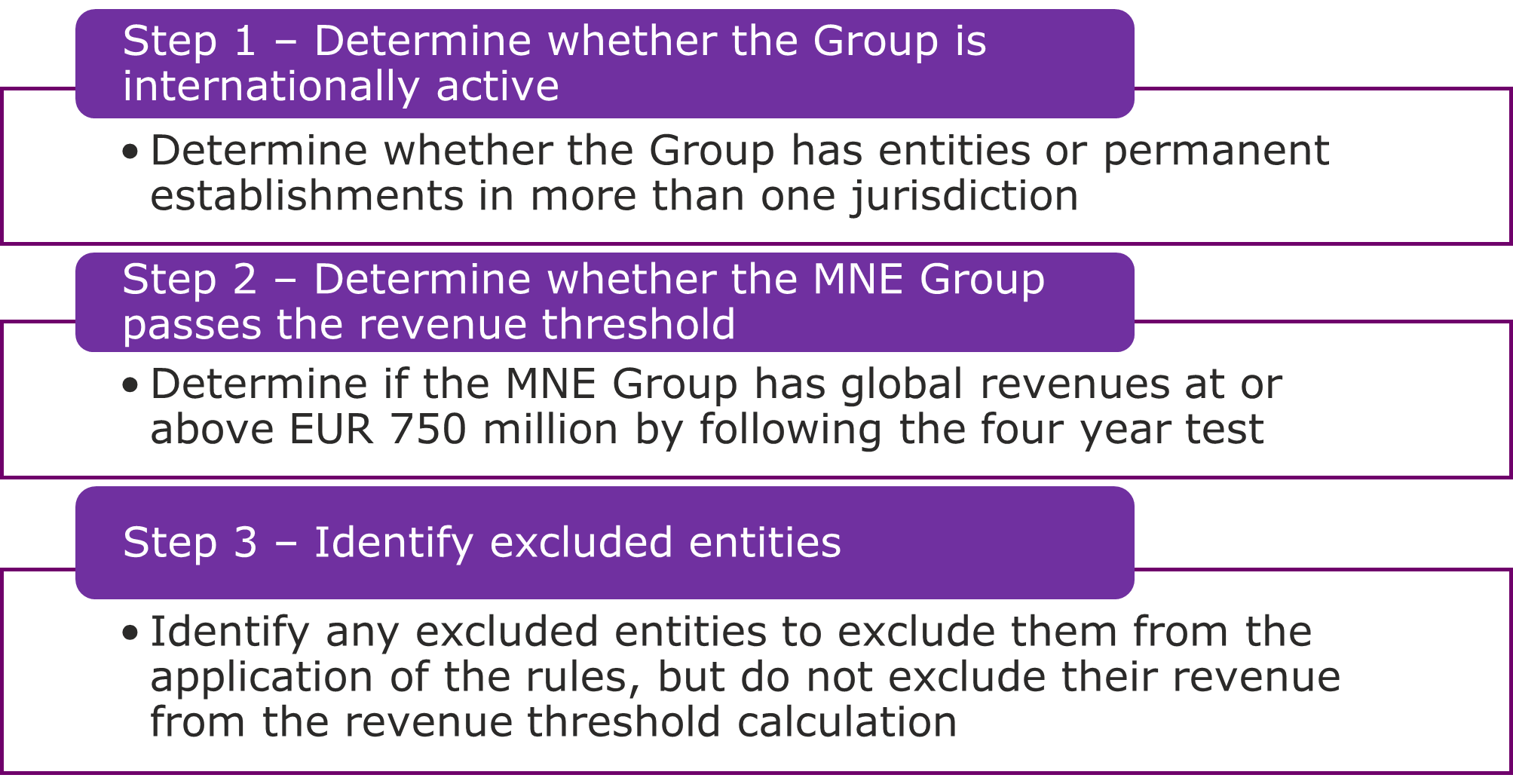

Paragraph 17 of the Pillar Two Implementation Handbook[2] explains that “DMTT rules include all the basic steps that an MNE Group must go through in order to calculate its top-up tax liability”, and that the first step is to determine whether the group is within scope, i.e., whether it qualifies as an MNE Group.

Paragraph 18 explains how to answer this question:

Further, para 19 of the Handbook outlines the “MNE Group Test”: “The first step is to determine whether the Constituent Entity is a member of an internationally operating group… A Group will be internationally operating when it has entities or operations in more than one jurisdiction (i.e. an MNE Group)…”.

The Revenue Threshold Test is discussed separately in paragraph 21.

Thus, these are two distinct tests. The multinational attribute is assessed first, and the second step (the Revenue Threshold Test) is applied only if the first test is satisfied.

The OECD has not issued any specific guidance addressing a situation analogous to the one described. Nor do UAE authorities (including the Ministry of Finance or the FTA) provide clarifying rules. However, guidance from foreign tax administrations provides a consistent interpretive approach.

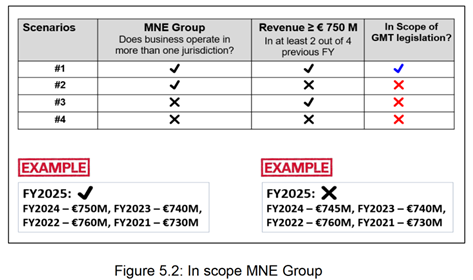

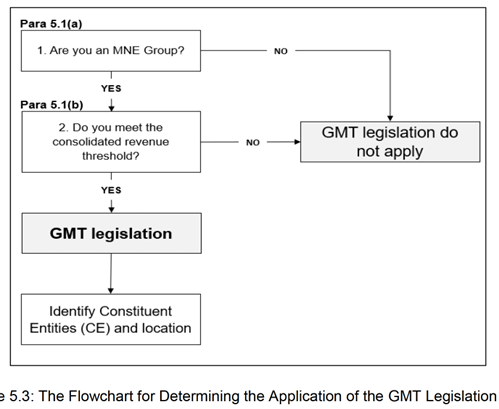

For instance, the Inland Revenue Board of Malaysia (IRB), in section 5.2 of its Implementation of Global Minimum Tax guidance (No. LHDN.AG.600-1/7/3, dated 2 December 2024), presents a decision-making algorithm (Figures 5.2 and 5.3):

The “two out of four” condition appears exclusively in the Revenue Threshold Test; it does not apply to the MNE Group Test.

This decision-making algorithm indicates that if the MNE Group Test is not satisfied, the Pillar Two rules do not apply, and there is no need to proceed to the Revenue Threshold Test.

The IRB has also published a set of Frequently Asked Questions on the implementation of the Global Minimum Tax (GMT) in Malaysia.[3]

Question 4 reads: “MNE Groups with consolidated revenues of at least EUR 750 million in at least two of the four preceding Financial Year will be in scope of GloBE Rules. Must the Group be an MNE Group or can it be a purely domestic group within these two out of four preceding Financial Years?”.

The IRB answers this question as follows: “The Group must be an MNE Group in the tested year and it is not necessary to have MNE status for two out of four preceding Financial Years. When testing the revenue threshold for two out of four financial years, the Group can be a purely domestic group”.

Therefore, even though the group exceeds the EUR 750 million revenue threshold in 2024 and 2025, this becomes irrelevant if the company ceases to qualify as an MNE Group in 2026. The closure of the Kazakh PE before the start of the fiscal year 2026 means:

- The company no longer has foreign operations;

- It is not part of an MNE Group in 2026;

- Step 2 of the in-scope test (the Revenue Threshold Test for 2022–2025) is not triggered, as Step 1 (the MNE Group Test) is failed in 2026.

Therefore, the company is not subject to DMTT in 2026.

[1] OECD (2025), Tax Challenges Arising from the Digitalisation of the Economy – Consolidated Commentary to the Global Anti-Base Erosion Model Rules (2025): Inclusive Framework on BEPS, OECD/G20 Base Erosion and Profit Shifting Project, OECD Publishing, Paris, https://doi.org/10.1787/a551b351-en.

[2] OECD (2023), Minimum Tax Implementation Handbook (Pillar Two), OECD/G20 Base Erosion and Profit Shifting Project, OECD, Paris, https://www.oecd.org/tax/beps/minimum-tax-implementation-handbook-pillar-two.pdf.

[3] FAQs version 4.1 (08/01/2025), https://www.hasil.gov.my/media/ltnbb3dl/faq-ver-41.pdf

The disclaimer

Pursuant to the MoF’s press-release issued on 19 May 2023 “a number of posts circulating on social media and other platforms that are issued by private parties, contain inaccurate and unreliable interpretations and analyses of Corporate Tax”.

The Ministry issued a reminder that official sources of information on Federal Taxes in the UAE are the MoF and FTA only. Therefore, analyses that are not based on official publications by the MoF and FTA, or have not been commissioned by them, are unreliable and may contain misleading interpretations of the law. See the full press release here.

You should factor this in when dealing with this article as well. It is not commissioned by the MoF or FTA. The interpretation, conclusions, proposals, surmises, guesswork, etc., it comprises have the status of the author’s opinion only. Furthermore, it is not legal or tax advice. Like any human job, it may contain inaccuracies and mistakes that I have tried my best to avoid. If you find any inaccuracies or errors, please let me know so that I can make corrections.