In April 2025, the UAE Federal Tax Authority (FTA) released the Corporate Tax Guide on Interest Deduction Limitation Rules (CTGIDL1), providing long- awaited guidance on the application of Ministerial rules related to financial and non-financial leases. These rules were originally introduced under Article 5 of Ministerial Decision No. 126 of 23 May 2023, which required taxpayers to identify and isolate the finance element embedded in both financial and nonfinancial lease payments.

The portion of lease payments identified as the finance element is to be treated as Interest for the purposes of calculating net interest. The latter is defined as the difference between interest expense and interest income. Where this net interest amount is positive, it becomes subject to the General Interest Deduction Limitation Rule (GILR). This reclassification is therefore not just a matter of presentation, but a key determinant of whether and to what extent interest expense is deductible for tax purposes.

Between the issuance of Ministerial Decision No. 126 and the publication of CTGIDL1, there had been no formal clarification on how these rules should be applied in practice. That changed with the release of CTGIDL1 on 7 April 2025, in which the FTA provided interpretive guidance and illustrative examples to support implementation.

This survey examines the clarifications offered by the FTA, highlights what uncertainties have been resolved, and identifies areas that remain open or potentially ambiguous.

FTA definitions of lease types

Article 5 of Minister of Finance Decision No. 126 of 2023 governs the determination of interest in the context of both finance and non-finance (operating) leases. The treatment differs significantly between these two types. However, the Decision does not provide statutory definitions to distinguish finance leases from non-finance leases. Instead, interpretive guidance is offered by the FTA in Sections 5.7 and 3.5.8 of Guide No. CTGIDL1. There, the FTA explains the difference between a finance lease and a non-finance lease as follows:

- ‘Under a finance lease contract, legal title of the asset remains with the lessor but the lease term usually covers a significant portion of the asset's useful life. The lessee typically assumes most of the risks and rewards of ownership of the asset, and is, for example, responsible for maintenance, insurance and other costs associated with the asset. The finance lease payments are typically structured to cover the full cost of the asset plus a financing charge over the lease term, which is similar to a loan1 repayment schedule’.

- ‘a non-finance lease, commonly referred to as an operating lease, is an arrangement where the lessor allows the lessee to use an asset for a specific period in exchange for rental payments. Unlike a finance lease, an operating lease does not provide the lessee with all the benefits and risks typically associated with ownership of the asset’.

The FTA’s definition of a finance lease only partially overlaps with the definition set out in Article 1 of Federal Decree-Law No. 32 of 25 September 2023 on Finance Lease. That law defines a finance lease as ‘a Lease whereby the Lessor leases out the Asset to the Lessee against a rent for a specific term, while the Lessee may be granted an option to own the Asset, pursuant to the provisions of Article (3) hereof’. The FTA, however, adopts a broader economic approach. For instance, it classifies hire purchase contracts, under which the lessee has an option to purchase the asset at the end of the term, as leases distinct from finance leases in form, but subject to the same tax rules as finance leases. This demonstrates that, for tax purposes, the classification hinges less on formal legal labels and more on the substantive characteristics and commercial outcome of the arrangement.

The FTA’s definitions of lease types differ slightly from those in IFRS 16. However, these differences appear to be semantic rather than substantive:

| Type of Lease | IFRS 16 | FTA |

| Finance lease | ‘a lease that transfers substantially all the risks and rewards incidental to ownership of an underlying asset’. | The lessee typically assumes most of the risks and rewards of ownership of the asset |

| Operating lease | ‘a lease that does not transfer substantially all the risks and rewards incidental to ownership of an underlying asset’. | Unlike a finance lease, an operating lease does not provide the lessee with all the benefits and risks typically associated with ownership of the asset’ |

The distinction between “substantially all” (IFRS) and “most” (FTA) is found only in the definitions of a finance lease. However, this apparent mismatch is effectively neutralized by the operating lease definition, which mirrors the same logic in reverse. Both frameworks rely on the economic substance of risk and reward transfer as the basis for classification, resulting in consistent practical outcomes.

Financial Lease

As per Clause 1 of Article 5 of the Decision No. 126/2023, the finance element of finance lease payments as documented in the accounts of a Taxable Person prepared in accordance with the Accounting Standards shall be considered Interest for the purposes of the General Interest Deduction Limitation Rule, and this includes both expenditure in relation to the finance cost element and income received therefrom’.

Hence, there should be no adjustments in determining interest component for tax purposes. This is confirmed by Sec. 3.5.7 of CTGGIDL1 where the FTA elucidates: ‘If an asset is recorded, the financing charge is Interest expenditure. If IFRS (or IFRS for SMEs) requires the lessor to record a finance element in respect of the contract, that finance element is Interest income’. Reference to a lessor in this quote should not mislead – Example 9 shows that an implicit interest component is treated as Interest expenditure incurred by the Lessee.

Non-Financial Lease

The Ministerial Decision devotes most of its regulatory detail to the treatment of non-finance leases, referred to as operating leases in IFRS. Under Article 5, the finance element embedded in such leases is likewise to be treated as Interest for the purposes of the General Interest Deduction Limitation Rule (GILR), and ‘this includes both expenditure in relation to the finance cost element and income received therefrom’.

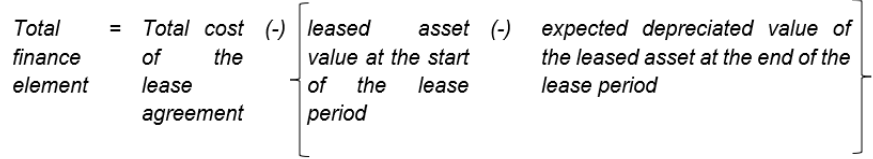

According to Clause 3 of Article 5, the finance element of non-financial lease is ‘the share of any lease payment that is in proportion to the share of the total cost of the lease as attributable to the total finance element’. As per Clause 4 of the same Article, the total finance element in this formula is ‘the total cost of the lease agreement less the value of the leased asset recognised on the date the lease was entered into less the expected depreciated value of the leased asset at the end of the lease. This shall be determined in accordance with the Accounting Standards and in accordance with the accounting policy of the Taxable Person in the year in which the lease was entered into’.

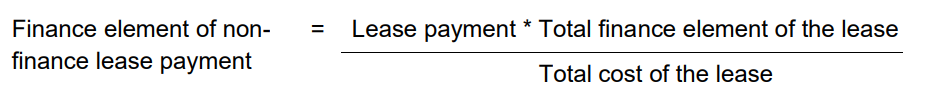

The FTA illustrates this in formulas:

In this formula, ‘lease payment is a specific instalment paid by the lessee to the lessor, and total finance element is the total financing cost over the lease term calculated as follows’:

Nothing in the Ministerial Decision initially indicated that the prescribed formulas apply exclusively to lessors. This limitation was only introduced later through the FTA’s clarification in Section 3.5.8 of CTGIDL1, which states: “For the lessor, there would be no finance element for accounting purposes, and therefore, the finance element, which is considered to be Interest, should be calculated” using the Ministerial formulas.

The FTA’s conclusion that there is no finance element for the lessor in an operating lease under IFRS makes perfect sense. Under IFRS 16, a lessor continues to classify leases as either finance leases or operating leases unlike lessees, who does not make this distinction. For operating leases, IFRS 16 mandates that:

- The leased asset remains on the lessor’s balance sheet.

- No lease receivable is recorded.

- Lease income is recognized straight-line (or another systematic basis if more representative) over the lease term.

Economically, this means the lessor is not viewed as extending financing but as retaining ownership and simply allowing the lessee to use the asset in exchange for rental payments.

Thus, under accounting principles, there is no “finance element” to recognize. The lease payments are pure rental income, not repayments of principal and interest. The Minister acknowledges this accounting reality but still requires an economic proxy to determine the financing cost embedded in lease payments for tax purposes. The given formula imputes an interest component from the idea that an operating lease implicitly includes a cost of funding, even if not disclosed in the lessor’s books.

Now, with the clarification provided by the FTA, we know that these formulas don’t apply to the lessee who recognizes a finance element under accounting rules. Under IFRS 16, the lessee does recognize a right-of- use (ROU) asset and a lease liability, and splits lease payments into:

- Interest expense on the lease liability (based on the discount rate – incremental borrowing rate (IBR) or interest implicit rate (IIR)),

- and principal repayment.

Therefore, for the lessee, the implicit interest is part of the IFRS accounting model and also acknowledged for tax purposes.

The operation of the above rules is best illustrated by Example 10 in the FTA’s Interest Deduction Guide.

The example concerns a non-finance lease of machinery between two UAE residents – Company K (lessor) and Company L (lessee) – structured with the following features:

- an initial asset value of AED 100,000,

- a five-year lease term with annual payments of AED 26,000, and

- a residual value of AED 20,000;

- a present value (PV) of the lease is given as AED 118,195, which was most likely calculated by the FTA on the assumption that the annual lease payments of AED 26,000 are payable at the beginning of each year.

- The “implicit interest rate” is said to be 5% per annum ‘calculated as the opening balance minus annual lease payment, multiplied by 5%’.

According to Appendix A of IFRS 16, the interest rate implicit in the lease (IIR) is defined as ‘the rate of interest that causes the present value of

- the lease payments and

- the unguaranteed residual value to equal the sum of

- the fair value of the underlying asset and

- any initial direct costs of the lessor’.

- IIR ensures the lease is treated like a financing arrangement, not just a rental.

In simple terms, IIR reflects the financing cost built into the lease, i.e., what the lessee is effectively paying in interest to "borrow" the asset instead of buying it. In other words, if the lessee were to buy the same asset upfront using a loan and then sell it at the end of the lease term, the IIR would be the interest rate that causes the cash flows from that loan scenario (i.e., purchase now, pay loan instalments, recover resale value later) to match the cash flows in the lease. This isn’t just an analogy, it’s essentially how the IIR functions in IFRS 16. It mirrors the economic substance of a financing arrangement, even though it’s structured legally as a lease.

From the outset, the FTA singles out the lessee to illustrate that Company L applies accounting rules for recognizing interest component in its cost: ‘For Company L (lessee): The lessee calculates implicit interest as AED 4,610 [(AED 118,195 less AED 26,000) * 5%] as per the relevant Accounting Standards followed by the Taxable Person which is considered as Interest’.

There is no further explanation, but we can find a rationale for this in IFRS 16 – the lessee is required to recognize a right-of-use asset and a corresponding lease liability, calculated as the present value of the future lease payments.

The lease liability in Example 10 is stated to be AED 118,195, discounted using a 5% interest rate implicit in the lease. Over the lease term, Company L (lessee) allocates the payments into two components:

- interest expense and

- principal repayment.

For instance, in the first year, the AED 26,000 payment is split into an interest expense of AED 4,610 (calculated as AED 92,195 × 5%) and the balance as a reduction of the lease liability. This treatment is consistent both for accounting and tax purposes that is clear now by virtue of the Guide (earlier, Art. 5(1) of the Ministerial allowed IFRS treatment only for finance lease)

Under IFRS 16, the lessor continues to distinguish between finance and operating leases: `

|

Financial Lease, IFRS 16:67, 68 |

Operating lease IFRS 16:81 |

|

At the commencement date, a lessor shall recognise assets held under a finance lease in its statement of financial position and present them as a receivable at an amount equal to the net investment in the lease. The lessor shall use the interest rate implicit in the lease to measure the net investment in the lease. |

A lessor shall recognise lease payments from operating leases as income on either a straight-line basis or another systematic basis. The lessor shall apply another systematic basis if that basis is more representative of the pattern in which benefit from the use of the underlying asset is diminished. |

So, in the case of an operating lease, the lessor does not recognize any finance element. The leased asset remains on the lessor’s balance sheet, 6 and lease payments are recognized as rental income, typically on a straight-line basis. There is no lease receivable, no interest income, and no unwinding of an implicit rate. This treatment reflects the fact that, under an operating lease, the lessor retains the risks and rewards of ownership, and the lease is viewed as a service contract, not a financing arrangement.

However, for tax purposes, the UAE Corporate Tax framework overrides this accounting neutrality. The Ministerial Decision (Article 5(3)–(5)) and Section 5.8 of the Guide require the lessor to calculate an imputed finance element, which is to be treated as “Interest” for the purpose of applying the GIDL. This recharacterization does not derive from the financial statements but from a statutory formula intended to approximate the economic cost of financing embedded in the lease payments.

The above formula applies in Example 10 as follows:

- Total cost of lease = AED 26,000 × 5 = AED 130,000

- Total finance element = AED 130,000 – (AED 100,000 – AED 20,000) = AED 50,000

- Finance portion of annual lease payment = AED 26,000 × (50,000 ÷ 130,000) ≈ AED 10,000

Consequently, the lessor, though not recognizing any interest income under IFRS, is required to treat AED 10,000 per year as interest income for Corporate Tax purposes. This fiction aligns with the policy intent of the GIDL: to capture the time value of money embedded in arrangements that function as de facto financing, even when accounting does not reflect this feature of economic reality.

Example 10 confirms the dual-layered system now embedded in the UAE Corporate Tax framework. For lessees, the treatment of interest aligns with accounting unless an exemption applies. For lessors, the tax law introduces an economic override, imputing interest into what is otherwise characterized as a pure rental contract. Again, the application of the Ministerial formula to lessors only becomes clear through Section 5.8 of the Guide. Prior to this clarification, one could interpret the statutory language as applying to both sides of the lease.

Reclassifying rental income into deemed interest income typically increases the lessor’s net interest position. As a result, it lowers the risk of triggering the GIDL threshold. Hence, the rule does not aim to restrict deductions for lessors. Instead, it ensures consistent treatment of economically similar lease structures on both sides of the transaction.

Unresolved treatment of Interest in exempt leases

It is still unclear whether the lessee should follow accounting rules in full where they provide for exceptions from singling the finance component out of lease costs. Under IFRS 16, the lessee is generally required to recognize a right-of-use (ROU) asset and a lease liability,[1] with lease payments disaggregated into interest expense and principal repay- ment.[2] This treatment applies for both financial and non-financial leases.

However, two well-established exemptions allow the lessee to avoid capitalization, and thus eliminate the finance element from lease accounting altogether.[3]

The first exemption applies to short-term leases, defined as leases with a term of 12 months or less and no purchase option.[4] The second applies to leases of low-value assets, which typically includes individual assets with a value of less than USD 5,000 when new.[5] In both cases, the lessee may elect to apply a simplified accounting treatment, recognizing lease payments as straight-line expense, with no lease liability and no interest expense. The rationale is materiality. Where the lease is insignificant in value or duration, the cost of disaggregation outweighs the informational benefit.

The complication arises in the tax context. If the lessee makes such an accounting policy election, it will not recognize interest expense in its books, and therefore no interest deduction would arise. This raises the question: should the lessee apply the Ministerial formulas to single out finance component?

Article 5(1) of Ministerial Decision No. 126/2023 clearly affirms that ‘the finance element of finance lease payments’ shall be considered Interest for the purposes of GILR ‘as documented in the accounts of a Taxable Person prepared in accordance with the Accounting Standards’. However, Article 5(1) does not provide support for interest treatment in any arrangement other than a finance lease. Therefore, it offers no authority to address the treatment of exempt leases, such as short-term or low- value leases where the lessee has elected simplified accounting under IFRS

Indeed, if a finance lease were to fall within the scope of a short-term or low-value lease exemption, and the lessee opts not to recognize the right-of-use asset and lease liability, a literal interpretation of Article 5(1) suggests that no interest would be recorded in the accounts, and consequently, no interest would be deductible for tax purposes. This outcome follows directly from the reliance on “interest as documented in the accounts.” It implies that, in theory, parties could avoid recognizing any interest at all neither in accounting nor in tax.

However, this opportunity exists only in theoretical terms. The FTA describes a finance lease as one where ‘the lease term usually covers a significant portion of the asset's useful life… The finance lease payments are typically structured to cover the full cost of the asset plus a financing charge over the lease term, which is similar to a loan repayment schedule’. This definition requires that the lease term covers a significant portion of the asset's useful life. That criterion cannot be satisfied by a lease of 12 months or less unless the underlying asset has an extremely short economic life. Besides, finance leases also presume that the payments cover most or all of the asset’s cost, plus interest. A short-term lease, unless heavily front-loaded, rarely covers the full cost of the asset.

So, let’s get back to non-financial lease.

Articles 5(2) to 5(4), which prescribe the formula-based approach to identifying the finance element in non-finance leases, do not contain any express exemption for the lessee. Instead, the FTA introduced such an exemption through interpretive guidance in Section 5.7 of the CTGIDL1: ‘The lessee may be required under IFRS (or IFRS for SMEs) to record its ‘right of use’ as an asset. If an asset is recorded, the financing charge is Interest expenditure’.

This phrasing suggests that interest arises only where the lessee capitalizes the ROU asset. The implication is that where the asset is not recorded, as in the case of short-term or low-value leases, no financing charge exists, and thus, no interest expenditure arises for GILR purposes.

However, this interpretation raises an apparent inconsistency. In Section 5.8, the FTA justifies applying the statutory formula to lessors in operating leases on the basis that IFRS does not require them to recognize a finance element. By analogy, if the lessee’s accounting policy election results in no recognition of the interest component, then the same reasoning (to apply the formula to fill the gap) could arguably extend to lessees as well. That is, wherever the lessee’s accounting policy does not produce an interest component, the tax law should step in with an imputed finance charge, especially where the economic substance of the lease mimics financing.

Nonetheless, this view runs into a textual barrier in Clause 4 of Article This Clause provides the methodology for calculating the “total finance element” for non-financial lease. It reads: ‘… the total finance element is the total cost of the lease agreement less the value of the leased asset recognised on the date the lease was entered into less the expected depreciated value of the leased asset at the end of the lease. This shall be determined in accordance with the Accounting Standards and in accordance with the accounting policy of the Taxable Person in the year in which the lease was entered into’.

At first glance, this clause could be used against reclassification of exempt lease payments. It seemingly recognizes the lessee’s own accounting policy as the framework within which the finance element is to be measured. If the lessee’s policy results in no recognition of the lease asset, then one could argue that no finance element can be derived at all.

However, a closer reading suggests that the reference to accounting policy in Clause 4 serves a narrow purpose: namely, to determine the value of the lease asset at inception and its expected depreciated value at lease end, for the purpose of calculating the total finance element. It does not expressly authorize or require the tax treatment to follow the accounting exemption in the case of lessees who elect not to capitalize the lease. Therefore, in our view, this clause may not shield the lessee from reclassification where the underlying lease transaction carries the economic characteristics of financing.

In view of the above, there is currently a regulatory gap in the UAE tax framework regarding exempt leases. While the FTA's guide appears to follow the accounting treatment by denying interest where the ROU asset is not recognized, a purposive reading of the Ministerial Decision may suggest otherwise. In particular, the FTA’s rationale for applying the imputation formula to the lessor could support extending the same method to lessees who otherwise escape interest recognition due to accounting policy elections. This ambiguity warrants clarification, especially as it affects the scope of interest deduction and its limitation under the GILR regime.

[1] IFRS 16:22.

[2] IFRS 16:26.

[3] IFRS 16:5.

[4] IFRS 16, App. A, Term 26.

[5] While IFRS 16 does not prescribe a specific monetary threshold for identifying low-value leases, the IASB clarified in paragraph BC100 of the Basis for Conclusions that it had in mind leases of assets with a value, when new, of approximately USD 5,000 or less. However, the USD 5,000 figure is illustrative rather than prescriptive and does not form part of the standard itself. Entities should exercise professional judgment in determining whether an asset qualifies as low value, considering both the asset’s nature and value when new, and the context of the lease arrangement. The exemption may be applied on a lease-by-lease basis in line with the guidance in IFRS 16:B3–B8. Examples of low-value underlying assets can include tablet and personal computers, small items of office furniture and telephones (B8).

The disclaimer

Pursuant to the MoF’s press-release issued on 19 May 2023 “a number of posts circulating on social media and other platforms that are issued by private parties, contain inaccurate and unreliable interpretations and analyses of Corporate Tax”.

The Ministry issued a reminder that official sources of information on Federal Taxes in the UAE are the MoF and FTA only. Therefore, analyses that are not based on official publications by the MoF and FTA, or have not been commissioned by them, are unreliable and may contain misleading interpretations of the law. See the full press release here.

You should factor this in when dealing with this article as well. It is not commissioned by the MoF or FTA. The interpretation, conclusions, proposals, surmises, guesswork, etc., it comprises have the status of the author’s opinion only. Furthermore, it is not legal or tax advice. Like any human job, it may contain inaccuracies and mistakes that I have tried my best to avoid. If you find any inaccuracies or errors, please let me know so that I can make corrections.