On 27 May 2025, the UAE Federal Tax Authority (FTA) published the first comprehensive Corporate Tax Guide on Family Foundations No. CTGFF1, clarifying the tax treatment of UAE and ADGM-based foundations under UAE Corporate Tax Law. The Guide confirms that family foundations approved under Article 17 of the Corporate Tax Law can elect to be treated as Unincorporated Partnerships (i.e. tax transparent).

Such transparency allows the foundation’s income, expenditure, assets, and liabilities to flow through to the beneficiaries, provided the foundation exists solely to manage and preserve family wealth.

Legal Shift: introduction of DMTT

Since the Ministry of Finance's earlier guidance on family foundations, a fundamental shift has occurred:

- Cabinet Decision No. 142 of 31 December 2024 implemented the Domestic Minimum Top-up Tax (DMTT), modeled on the OECD Pillar Two GloBE Rules.

- Ministerial Decision No. 88 of 28 March 2025, incorporating the OECD Model Rules, Commentary, and Administrative Guidance, formalized the UAE’s alignment with the Inclusive Framework on BEPS Pillar Two.

This legislative framework introduces a new layer of compliance for large UAE groups (revenue ≥ EUR 750 million) where tax-transparent entities, such as Family Foundations and their subsidiaries, are used.

Transparency under UAE CT Law vs. GloBE Rules

Under Article 17(1) of the Corporate Tax Law and as further elaborated in Ministerial Decision No. 261 of 28 October 2024, a foundation and its wholly owned subsidiaries can be treated as fiscally transparent entities for Corporate Tax purposes. However, for UAE DMTT purposes Article 18.1(a) of the Decision No. 142/2024 defines an “Entity” as ‘any juridical person … … but does not include natural person…’. Therefore, family members do not represent an entity for the purpose of DMTT, but a foundation, which is a legal juridical person does. As a result, while family members (as natural persons) do not constitute an “Entity” under the DMTT framework, a Family Foundation, being a juridical person, does.

Further, Article 1.1.1 of the Cabinet DMTT Rules includes ‘Constituent Entities that are members of an MNE Group that has annual revenue of EUR 750 million or more in the Consolidated Financial Statements of the Ultimate Parent Entity …’ in the scope of the DMTT. The definition of a UPE in Article 1.1.1(c) refers to ‘an Entity that owns directly or indirectly a Controlling Interest in any other Entity, and is not owned, with a Controlling Interest, directly or indirectly by another Entity’.

Accordingly, the EUR 750 million threshold and MNE Group classification may not apply where family members directly own real estate or business assets, either individually or through arrangements that do not involve a juridical entity. However, where such assets are held through a Family Foundation, the foundation, being a juridical person, may qualify as a UPE, thereby triggering Pillar Two scope tests under the DMTT regime.

The fiscal transparency status of the foundation and its subsidiaries for Corporate Tax purposes does not shield the structure from Pillar Two exposure. Pursuant to Articles 3.5.2(c) and 3.5.4 of the UAE DMTT Rules, the income of Ultimate Parent Entities that are treated as transparent for domestic (Corporate Tax) purposes is nonetheless attributed to them for DMTT purposes. In effect, such entities are not treated as transparent under the DMTT framework, and their income is fully included in the Financial Accounting Net Income or Loss (FANIL) calculations.

Further, under Article 4.2.1, Covered Taxes are limited to taxes borne by Constituent Entities. Taxes paid by individual beneficiaries, even on income allocated to them from transparent vehicles, are not recognized as Covered Taxes. Moreover, Article 4.3.2(b) confirms that any Covered Taxes recorded in the financial accounts of a tax transparent entity may only be attributed to a Constituent Entity owner, thereby excluding natural persons (not a Constituent Entity) from attribution.

As a result, the use of a transparent vehicle such as a Family Foundation leads to inclusion of income in the Effective Tax Rate (ETR) denominator, while no corresponding Covered Taxes can be allocated to the numerator—potentially triggering a top-up tax even where the ultimate beneficiaries are already taxed in their own jurisdictions.

A foundation holding real estate property in the UAE

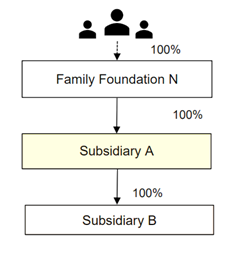

Referencing Example 6 of the FTA Guide No. CTGFF1, consider the following:

However, under UAE DMTT Rules, all three entities are Constituent Entities:

- Income of these entities should be included in the Financial Accounting Net Income or Loss (Art. 3.1.2).

- No taxes are paid by the entities themselves. Thus, Covered Taxes are equal to zero (Artiles 4.3.1 and 4.3.2).

- Result: ETR = 0%, triggering exposure to Top-up Tax under Article 5 of Cabinet Decision No. 142/2025.

In Example 6, all entities are located within the UAE, which means the structure does not meet the definition of an in-scope MNE Group under Article 1.1.1 of the DMTT Rules. However, if the example is modified by relocating one subsidiary (e.g., Subsidiary C) to France, the group would then qualify as an MNE Group, as it would include Constituent Entities in more than one jurisdiction. As a result, the UAE DMTT provisions would become applicable. For instance:

- Real estate income: AED 20,000,000

- Top-Up Rate (assuming ETR = 0%): 15%

- DMTT payable: AED 3,000,000

By contrast, if the same properties were held directly by family members:

- No group exists.

- Individuals are not Entities under GloBE (Article 18.1(a) of the Decision No. 142/2024).

- No ETR calculation or DMTT arises.

Suppose now that one of the beneficiaries of Family Foundation N is a French tax resident individual. French domestic law taxes the individual's share of income under pass-through treatment principles. The individual declares and pays personal income tax in France on their allocable portion of the UAE real estate income.

However, under the OECD GloBE rules:

- Tax paid by the French individual is not attributed to Family Foundation N or its UAE subsidiaries (Articles 4.3.1 and 4.3.2).

- Covered Taxes = 0, despite full taxation in France.

- The UAE entities remain within the DMTT scope to be taxed with 15% UAE DMTT .

Thus, even if the individual pays 45% tax in France, the ETR is still 0%, and a Top-up Tax of 15% applies under the UAE DMTT regime.

Applicability of Investment Entity Exemption

Article 2.3 of the UAE DMTT Rules provides that ‘an Investment Entity located in the UAE is not subject to the Top-up Tax’. Clauses (e) and (f) of Article 1.5 treats ‘an Investment Fund that is an Ultimate Parent Entity; or … a Real Estate Investment Vehicle that is an Ultimate Parent Entity’[1] as Excluded Entities.

Thus, a reasonable question arises: Shouldn't the investment entity exemption apply to such Family Foundations?

Article 18.1 of the DMTT Rules defines “Investment Entity as primary investment entities (‘an Investment Fund, a Real Estate Investment Vehicle or Insurance Investment Entity’), their investment holding entities controlled by primary investment entities and their passive investment affiliates.

While Family Foundations may hold and manage a portfolio of assets, they do not meet the definition of an “Investment Fund” under Article 18.1 of the UAE DMTT Rules. This provision requires, among other things, that

- the Entity pools assets from a number of investors, including some who are not connected, and

- the Entity or its management is subject to a regulatory regime in the Jurisdiction in which it is established or managed (including appropriate anti-money laundering and investor protection regulation).

In contrast, Family Foundations are typically private vehicles established to preserve and manage wealth for a single family group. There is no pooling of third-party capital, no investor diversity, and no regulatory oversight consistent with investment fund regimes, i.e. they are not subject to the level of investor protection contemplated by paragraph (f). Therefore, they fail to satisfy multiple cumulative criteria under Article 18.1 and cannot be treated as Investment Funds or entities eligible for exclusion on that basis.

Although a Family Foundation may hold immovable property, it does not meet the definition of a Real Estate Investment Vehicle (REIV) under Article 18.1 of the UAE DMTT rules, which adopts the OECD GloBE definition. A qualifying REIV must

(i) achieve a single level of taxation—either at the entity level or in the hands of its investors (with no more than one year of deferral),

(ii) predominantly hold immovable property, and crucially,

(iii) be widely held.

A typical Family Foundation is privately held for the benefit of a small, related group of individuals (e.g., members of a single family), and therefore fails the “widely held” requirement. Accordingly, Family Foundations do not qualify as REIVs under Article 18.1 and cannot be excluded from GloBE or DMTT rules on that basis.

Therefore, despite earning passive income, the Family Foundation does not qualify for the Investment Entity exemption and remains in-scope for DMTT.

[1] Both Investment Fund and Real Estate Investment Vehicles are included in the definition of “Investment Entity”.

Conclusions

Family Foundations structured as transparent vehicles may still fall within the GloBE tax base, while tax paid by individuals remains invisible. Despite full alignment with UAE Corporate Tax exemptions, these arrangements may trigger DMTT obligations due to low ETR outcomes.

For groups approaching the EUR 750 million threshold, especially those with real estate passive investment, or other investment which qualify for personal investment exception under the UAE Corporate Tax legislation, this mismatch can be financially material. Stakeholders and their advisors should reassess legacy structuring involving transparent vehicles with revenues exceeding Pillar 2 threshold. In Pillar Two, transparency is not always tax-efficient.

The disclaimer

Pursuant to the MoF’s press-release issued on 19 May 2023 “a number of posts circulating on social media and other platforms that are issued by private parties, contain inaccurate and unreliable interpretations and analyses of Corporate Tax”.

The Ministry issued a reminder that official sources of information on Federal Taxes in the UAE are the MoF and FTA only. Therefore, analyses that are not based on official publications by the MoF and FTA, or have not been commissioned by them, are unreliable and may contain misleading interpretations of the law. See the full press release here.

You should factor this in when dealing with this article as well. It is not commissioned by the MoF or FTA. The interpretation, conclusions, proposals, surmises, guesswork, etc., it comprises have the status of the author’s opinion only. Furthermore, it is not legal or tax advice. Like any human job, it may contain inaccuracies and mistakes that I have tried my best to avoid. If you find any inaccuracies or errors, please let me know so that I can make corrections.