This case study explores the corporate tax implications under the UAE Corporate Tax Law when a Free Zone-based developer engages in residential property projects located both in the UAE mainland and within a Qualifying Free Zone. It focuses on analyzing the treatment of such income under Cabinet Decision No. 100 of 25 October 2023 and Ministerial Decision No. 265 of 27 October 2023, while considering the structure where a development arm (Construction Co) provides services to a property holding company (Property Co), both of which are registered in Qualifying Free Zones.

Facts

Property Co is incorporated in a Qualifying Free Zone (e.g. JAFZA or DIFC) and owns two parcels of residential land:

- Parcel A is located in the mainland area of Dubai.

- Parcel B is located in a Qualifying Free Zone.

Construction Co, a wholly owned subsidiary of Property Co, is incorporated in Meydan Free Zone and intends to provide construction and development services for both parcels.

Both entities aim to benefit from the 0% Corporate Tax rate applicable to Qualifying Free Zone Persons (QFZPs) on Qualifying Income.

Property Co intends to lease or sell the developed residential units to third parties.

Construction Co provides development services and construction works exclusively to Property Co and seeks to classify its revenue as Qualifying Income.

Questions

- Does the income earned by Property Co from leasing or selling the residential properties qualify for the 0% Corporate Tax rate?

- Can Construction Co classify the income it earns from providing development services to Property Co as Qualifying Income?

- How do the locations of the properties (mainland vs. Free Zone) impact the Corporate Tax treatment?

Summary

Upon examination of the applicable legislation, we concluded that:

- Income from leasing or selling residential property is generally considered an Excluded Activity for QFZPs and is therefore subject to standard Corporate Tax at 9%, regardless of the property’s location—whether in the mainland or in a Free Zone.

- Income earned by Construction Co, a QFZP, from providing development services to another Free Zone entity (Property Co), could be treated as Qualifying Income, and therefore eligible for the 0% Corporate Tax rate, but only in relation to parcels located in the mainland.

- The location of the property is critical. For non-commercial property located within a Qualifying Free Zone, the legislation explicitly subjects such income to 9% tax, even if derived from a service relationship between Free Zone Persons. By contrast, in the case of mainland property, such a specific exclusion is absent, and a more favorable interpretation may be available, although the FTA may still dispute the 0% rate based on a purposive reading of the law.

- However, the FTA may challenge this treatment by arguing that income from construction and development services on non-commercial property constitutes “income from immovable property”, which is excluded from the 0% Corporate Tax regime regardless of the location of the immovable property.

- Due to interpretative risks, it is recommended to seek private clarification from the FTA prior to applying the 0% Corporate Tax rate on income from construction and development activities.

Analysis

Under the UAE Corporate Tax Law,[1] a Qualifying Free Zone Person ('QFZP') would be eligible for 0% Corporate Tax on its Qualifying Income, subject to meeting the prescribed conditions. However, per Cabinet Decision No. 100/2023,[2] any income from “excluded activities” does not form part of Qualifying Income and is instead treated as non-Qualifying Revenue.[3]

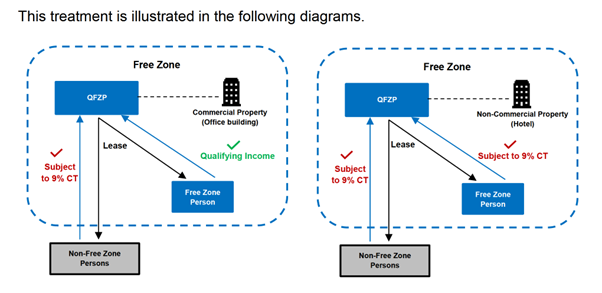

As per Ministerial Decision No. 265/2023,[4] ownership or exploitation of immovable property other than Commercial Property located in a Free Zone where the transaction in respect of such Commercial Property is conducted with a Free Zone Person, is considered as “excluded activity”.

Accordingly, the sale or lease of residential villas by Property Co would fall within the scope of excluded activity and will therefore not be eligible for the 0% Corporate Tax rate applicable to QFZPs. Instead, such income will be taxed at the standard Corporate Tax rates: 0% on the first AED 375,000 of taxable income, and 9% on the amount exceeding AED 375,000.[5]

Besides, Article 6 of Cabinet Decision No. 100/2023 sets forth that “income derived from immovable property located in a Free Zone from … transactions with any Person in respect of immovable property that is not Commercial Property” is subject to 9% Corporate Tax rate. This additionally disqualifies income from leasing or selling residential property located in Qualifying Free Zones from the scope of 0% tax rate.

Construction Co and Property Co are established in Qualifying Free Zones. Accordingly, both qualifies as 'Free Zone Persons' under the Corporate Tax Law, which defines a Free Zone Person as "a juridical person incorporated, established or otherwise registered in a Free Zone, including a branch of a Non-Resident Person registered in a Free Zone."[6]

As per Article 3(1)(a) of Cabinet Decision No. 100/2023, income derived from transactions with a Free Zone will be treated as Qualifying Income of a QFZP. Under the UAE Corporate Tax Law. Qualifying Income of a QFZP attracts Corporate Tax at 0%.

However, Article 3(1)(a) of Cabinet Decision No. 100 of 2023 restricts the preferential treatment to operations that do not qualify as Excluded Activities. The list of Excluded Activities is provided in Article 2(2) of Ministerial Decision No. 265 of 27 October 2023. Paragraph (e) of that list includes "ownership or exploitation of immovable property, other than Commercial Property located in a Free Zone where the transaction in respect of such Commercial Property is conducted with a Free Zone Person".

In our view, this exception does not cover construction works or arrangements of construction works.

According to Article 880(1) of Civil Transaction Law “the construction of buildings or other fixed installations” is a subject matter of Muqawala (contract to make a thing or to perform a task)[7]. This is a type of “contracts of works”.[8]

These works are carried out on immovable property and result in the creation of immovable property, but they do not constitute ownership or exploitation of immovable property.

Another relevant exclusion is provided under Clause 1 of Article 3 and Clause 1(b) of Article 6 of Cabinet Decision No. 100 of 2023, which states: "Income derived from immovable property located in a Free Zone from the below transactions shall be considered Taxable Income and taxed [with 9% rate]: … b. Transactions with any Person in respect of immovable property that is not Commercial Property". The scope of this rule is broader than that under the Ministerial Decision. It refers to income derived in respect of immovable property, and not only to ownership or exploitation.

However, this broader scope is expressly limited to property located in a Free Zone. So, the plot located in the mainland does not fall within the scope of this exclusion under the Cabinet Decision.

Despite this, the FTA may adopt a broader interpretation of the legislation and argue that construction works and related arrangements fall within the meaning of “income from ownership or exploitation of immovable property.” For instance, in VAT Public Clarification VATGRE1, the FTA includes a 'supply of services involving the preparation, coordination and performance of construction, destruction, maintenance, conversion or similar work' as an example of " real estate related services". This reference is drawn from Article 21(3)(e) of the VAT Executive Regulation.

In our view, this VAT logic should not be extended to the exclusions from the 0% Corporate Tax rate, as the Corporate Tax legislation limits the exclusion to income from ownership and exploitation of immovable property rather than to an income from real estate related services. The distinction is consistent with the terminology in Articles 5 and 7 of the OECD Model Tax Convention, which differentiate between income from immovable property and income from a building site, construction, or installation project.

In Section 8.1 of CTGFZP1, the FTA clarifies that “an Immovable Property is a property which is settled and fixed in its space and cannot be moved without deterioration or alteration of its shape. On the contrary, movable constructions (for example, construction sites or temporary structures) will not be considered as Immovable Property”.

This definition establishes a clear distinction between permanent real estate assets (immovable property) and temporary or transitional structures, such as construction sites or mobile units. Importantly, it also differentiates between a construction site and immovable property, which is highly relevant when assessing the nature of the property a contractor or developer interacts with during the building process. A contractor operates on the site to construct the building, but does not exploit the building in the legal or economic sense associated with ownership or usage rights. Therefore, the contractor’s activity, focused on creating the immovable property rather than owning or exploiting it, may not be classified as ownership or exploitation of Immovable Property.

Section 8.2 of the same Guide addresses the treatment of “income that a QFZP derives from Immovable Property located in a Free Zone”:

However, this section does not address the treatment of operations involving non-Commercial Property located outside a Free Zone. Its scope is confined to income from Free Zone-based immovable properties, which limits its interpretive value for mainland projects.

Clarification on the tax treatment of “Immovable Property located outside a Free Zone” is provided in Section 8.3. This section includes only one paragraph, which states: “The ownership or exploitation of Immovable Property located outside of a Free Zone is an Excluded Activity. This means that the income from Immovable Property located outside of a Free Zone would be taken into consideration when applying the de minimis requirements, unless the income is attributable to a Foreign Permanent Establishment or a Domestic Permanent Establishment”.

This conclusion is based on Article 2(2)(e) of Ministerial Decision No. 265 of 2023, which excludes: “ownership or exploitation of immovable property, other than Commercial Property located in a Free Zone where the transaction in respect of such Commercial Property is conducted with a Free Zone Person”.

Construction Works in Dubai are defined as “any construction, demolition, or maintenance works of buildings, or any additions or modifi cations thereto”.[9] Development is defined as a “general term for the construction, erection or placing of a building or structure; the making of an addition or alteration to a building or structure; a significant change in use or in intensity of use of any building or structure”.[10]

Applying the FTA’s own definition, a construction site does not qualify as immovable property. Furthermore, contractors do not “own” or “exploit” the property; they create it. Therefore, construction and development activities should not fall within the “ownership or exploitation” exclusion that triggers the standard 9% Corporate Tax rate.

This interpretation extends to developers such as Construction Co. As they do not “own” or “exploit” property but instead build and transfer it, their income should not fall within the scope of excluded activities.

Nevertheless, the FTA may invoke a purposive interpretation and argue that it is unlikely the legislator intended to tax income from non-commercial property located in a Free Zone while exempting similar income from property outside the Free Zone. This line of reasoning could potentially be raised in litigation.

Due to the high level of risk and potential for disagreement by the FTA, it could be prudent to apply the 9% Corporate Tax rate to Construction Co’s income unless a private clarification is obtained from the FTA supporting the preferential treatment.

[1] Article 3(2)(a) of Corporate Tax Law.

[2] Article 1 and Article 3(1)(a) and (b) of Cabinet Decision No. 100/2023.

[3] Article 4(2)(a) of Cabinet Decision No. 100/2023.

[4] Article 2(2)(e) of Ministerial Decision No. 265/2023.

[5] Article 3 of Corporate Tax Law read with Article 2 and 3 of Cabinet Resolution No. 116/2022.

[6] Article 1 of Corporate Tax Law.

[7] Civil Transaction Law, Article 872.

[8] Ibid, Section 3 heading.

[9] Local Order No. 3 of 1999 Regulating Construction Works in the Emirate of Dubai, Art.1.

[10] Dubai Building Code, A.2.1.

The disclaimer

Pursuant to the MoF’s press-release issued on 19 May 2023 “a number of posts circulating on social media and other platforms that are issued by private parties, contain inaccurate and unreliable interpretations and analyses of Corporate Tax”.

The Ministry issued a reminder that official sources of information on Federal Taxes in the UAE are the MoF and FTA only. Therefore, analyses that are not based on official publications by the MoF and FTA, or have not been commissioned by them, are unreliable and may contain misleading interpretations of the law. See the full press release here.

You should factor this in when dealing with this article as well. It is not commissioned by the MoF or FTA. The interpretation, conclusions, proposals, surmises, guesswork, etc., it comprises have the status of the author’s opinion only. Furthermore, it is not legal or tax advice. Like any human job, it may contain inaccuracies and mistakes that we have tried my best to avoid. If you find any inaccuracies or errors, please let us know so that we can make corrections.