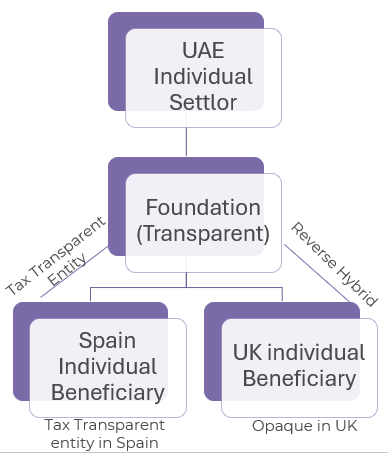

This case study examines the interaction between domestic classifications of a UAE transparent foundation and its treatment under the Pillar Two (GloBE) Model Rules and UAE DMTT Rules, in a setting where the ultimate owners are individual residents of two different jurisdictions. The analysis focuses on a UAE foundation that is fiscally transparent under UAE law and is treated, for GloBE purposes, as a Flow-through Ultimate Parent Entity. Its two equal beneficiaries are resident in Spain and the United Kingdom respectively.

Facts

A UAE foundation is established and registered in the UAE and approved domestically for an Unincorporated Partnership treatment. Under UAE tax law, this entails full fiscal transparency: the foundation itself is not a taxpayer. Instead, all income, expenditure, profit or loss arising at the level of the foundation is attributed to, and taxable in the hands of, its beneficiaries.

For GloBE / Pillar Two purposes, the foundation is treated as the relevant “owner” of the underlying investments and operates, functionally, as the Ultimate Parent Entity (UPE) of a (small) group. It is also a Flow-through Entity for the purposes of Article 3.5 of the Model GloBE Rules.

There are two individual beneficiaries, each holding a 50% economic entitlement to the foundation’s assets and income:

- Beneficiary S: resident in Spain.

- Beneficiary U: resident in the United Kingdom.

In the relevant Fiscal Year, the foundation realizes income of 100, such that each beneficiary has an economic share of 50.

Questions

- For Pillar Two purposes, should the 50 of income economically attributable to Beneficiary S be treated as GloBE income of the Foundation (as the UPE)?

- Can any personal income tax paid by Beneficiary S in Spain on this income be allocated to the Foundation as Covered Taxes for UAE DMTT ETR purposes?

- For Pillar Two purposes, should the 50 of income economically attributable to Beneficiary U be treated as GloBE income of the Foundation (UPE)?

- Can personal income tax paid by Beneficiary U in the UK, whether on distributions or under a CFC-type inclusion, be allocated to the Foundation as Covered Taxes?

Summary

On a construction of the Model GloBE Rules and UAE DMTT Rules, read together with Spain’s look-through approach and the UK’s opaque classification of foreign foundations, the following conclusions emerge:

- The UAE transparent foundation is a Flow-through UPE and retains GloBE Income of 100.

- The Spanish personal income tax borne by Beneficiary S on their 50 share of the income cannot be allocated to the foundation as Covered Tax, because it is not a tax of a Constituent Entity and is not recognised in the financial accounts of any Constituent Entity-owner.

- The UK personal tax borne by Beneficiary U, whether on distributions or under anti-avoidance or CFC-type regimes applicable at the individual level, likewise cannot be allocated to the foundation as Covered Tax.

- Consequently, the GloBE ETR for the UAE jurisdiction is computed solely by reference to taxes borne by Constituent Entities (if any) in that jurisdiction, without regard to the substantial personal-level taxation imposed in Spain and the UK.

In short, Spain’s embrace of foreign transparency and the UK’s rejection of it both “disappear” at the GloBE level in this fact pattern. The Pillar Two mechanics treat the UAE foundation as the single taxable node for GloBE purposes, while the beneficiaries’ personal taxes remain conceptually and computationally outside the regime.

Analysis

The following analysis develops this conclusion in two stages. First, it sets out the relevant GloBE mechanics governing Flow-through Entities, Tax Transparent UPEs and the allocation of Covered Taxes within a group. Particular attention is given to the treatment of non-Constituent Entity owners and to the specific allocation rules for CFC and hybrid situations. Secondly, these rules are applied to the factual matrix of a UAE transparent foundation with Spanish and UK resident individual beneficiaries, taking into account Spain’s look-through approach to foreign transparent entities and the UK’s predominantly opaque, settlement-style treatment of foreign foundations. This allows us to demonstrate why, notwithstanding the divergent domestic qualifications, GloBE income and Covered Taxes remain entirely at the level of the Foundation.

Legal background

⒈ The key asymmetry lies in how the two residence jurisdictions classify and tax the UAE foundation.

Domestic Classification in Spain

1.1. Spain has moved decisively towards a tax-treatment-based classification of foreign entities. Under Spain’s Personal Income Tax,[1] Corporate Income Tax[2] and Non-Resident Income Tax[3] Laws and a pivotal 2020 Resolution,[4] foreign entities may be treated as “entidades en atribución de rentas” (transparent entities) where their tax treatment in the jurisdiction of incorporation is analogous to that of Spanish transparent entities. Spanish Directorate General of Taxes No. 38/2020 allows to conclude that:

1) the decisive factor is how the foreign entity is taxed in its home jurisdiction;

2) a detailed, formalistic comparison of legal forms is not required; and

3) where the foreign jurisdiction treats the entity as fiscally transparent and taxes at owner level, Spain will, in principle, respect that look-through treatment, assuming other conditions are met.

Applied to a UAE foundation that is treated as an Unincorporated Partnership and transparent for UAE corporate tax purposes, this implies:

a) Spain is likely to treat the UAE foundation as a look-through “entidad en atribución de rentas”.

b) A Spanish-resident beneficiary (Beneficiary S) will be taxed in Spain on their share of the underlying income on an accrual basis (here, 50), rather than solely on distributions or via a corporate CFC regime.

Spain is therefore one of the few jurisdictions where the foreign label “transparent” substantively matters to the classification of a foreign entity.

Domestic Classification in the UK

1.2. From a UK perspective, the classification of a UAE foundation is ultimately governed by HMRC’s foreign entity guidance rather than by the UAE’s label of tax transparency. The HMRC International Manual (INTM180010–INTM180040) confirms that every foreign entity must first be characterized, for UK tax purposes, as a company, partnership or trust/settlement, and separately as “transparent” or “opaque”, by reference to UK law concepts and the factual pattern of rights and obligations. INTM180020 makes this explicit: “In considering the factors … [given in this Manual] … we look at the foreign commercial law under which the entity is formed and at the internal constitution of the entity. How the entity is classified for tax purposes in any other country is not relevant”.

1.3. Commentary such as Croneri’s BTR 171-800, builds on this framework and emphasizes that the classification exercise is a balancing of attributes rather than a mechanical form-over-substance test:

- Features such as separate legal personality, limitation of liability, independence of the governing body and the beneficiaries’ lack of direct rights in the underlying assets tend to point towards an opaque, settlement- or company-type treatment,

- By contrast, bare-trust style arrangements with retained control and direct economic ownership can justify transparent treatment.

In parallel, Parkes’ discussion of foundations in the UK context notes that, in some cases (notably Liechtenstein foundations under the 2009 joint declaration)[5], the “starting position” may be to treat a foreign foundation as a form of trust. Where the founder retains extensive de facto control HMRC may even argue for bare trust (fully transparent) treatment. However, it follows from Parkes’ study that this outcome is fact-specific and depends on how far control has genuinely been surrendered, not on the mere label “foundation”.[6]

1.4. The 2009 Liechtenstein–UK Joint Declaration captures this approach. It provides that “trusts (“Treuhandschaften”) and foundations (“Stiftungen”) to be characterised, recognised and treated as trusts for UK tax purposes… For avoidance of doubt, a business activity is only allowed in case of charitable foundation or private foundations where a respective law specifically permits it. In case of family foundations, business activity is not permitted. Accordingly, while a foundation has its own legal personality, its essence and purpose is to preserve and maintain assets for the beneficiaries, as is that of a trust”.

At the same time, the Declaration includes an important reservation: “For avoidance of doubt, nothing contained herein is to affect the ability of affected persons to rely on UK law or practice permitting alternative characterisation, recognition and treatment. The parties further recognise that the ultimate UK taxation consequences for UK taxpayers will depend on the particular facts as is the case where UK or other common law entities or fiduciary relationships, such as trusts, are involved”.

This language is especially pertinent when analyzing DIFC, ADGM and RAK ICC foundations, whose contemporary concept “concept … has traditionally been associated with Liechtenstein since 1926”,[7] but whose UK treatment still depends on the general HMRC framework and the six-factor test, not on any automatic assimilation to Liechtenstein practice.

1.5. It is crucial, in this context, to separate “treated as a trust” from “treated as transparent”. Being treated as a trust or settlement for UK tax purposes does not mean that all income is automatically taxed on the founder or beneficiaries irrespective of distributions. Rather, it means that the structure is brought within the UK trust / settlement regimes, and taxation is then governed by:

- the rules on trustee-level income tax and Capital Gain Tax (CGT);

- the settlor-interested attribution rules; and

- the beneficiary matching rules for distributions and capital payments.

HMRC’s INTM180010 underlines this distinction. It notes that foreign entities are classified both as (a) partnership / company / trust and (b) “transparent” or “opaque”, and that the transparency label is simply a shorthand for who is taxable on what:

- A “transparent” entity is one where members are generally taxed on their share of the underlying profits as they arise.

- An “opaque” entity is one where members are generally taxed only on distributions.

INTM180030 then provides a list of foreign entities with a general HMRC view on transparency versus opacity: some unit trusts are treated as transparent (Australian unit trusts), others as opaque (Irish unit trusts); US real estate investment trusts (REITs) are classified as opaque. This confirms that being a “trust-like” vehicle does not predetermine transparency or opacity. The outcome depends on the six factors provided in INTM180020, and the relevant charging provisions.

1.6. The 2025 reforms to the non-dom regime, as analyzed by Charles Russell Speechlys,[8] illustrate the same point in a different way. From 6 April 2025, a UK-resident, formerly non-UK domiciled settlor of an offshore settlor-interested trust is no longer protected by the historic “trust protections”.

For such settlors, the trust becomes, in broad effect, “transparent” for income tax and CGT purposes, with foreign income and gains of the trust generally taxed on the settlor as they arise (subject to the new “qualifying new resident” regime). However, the trust itself has not changed legal nature: it is still treated as a trust. The reforms simply apply a stronger settlor-interested attribution rule, making a particular class of offshore trusts transparent as against the settlor for specific taxes. This underlines the central point:

- “Trust versus company” is a classification question.

- “Transparent versus opaque” is a tax incidence question that can vary by tax and by fact pattern.

1.7. Applying HMRC’s six-factor test in INTM180020 to the UAE foundation in the present case, the opaque attributes clearly dominate:

1) The foundation has separate legal personality, with its own patrimony and governance structure (Factor 1).

2) Neither the founder nor the beneficiaries have proprietary rights in the underlying assets. Those assets belong beneficially to the foundation itself (Factor 6).

3) The foundation, not its founder or beneficiaries, is responsible for debts incurred in its activities (Factor 5).

4) The beneficiaries’ rights are confined to receiving benefits in accordance with the foundation charter and regulations. They have no automatic entitlement to profits as they arise and no right to direct management (Factors 3–4).

On our assumed facts, distributions are in the full discretion of the foundation council, leaving the founder and beneficiaries with very limited ability to affect distributions or to remove the foundation. They are also distant from the investment activity carried on by the foundation. This pattern is far removed from a bare trust or partnership-style arrangement and is closely aligned with the type of non-transparent entity described in HMRC’s examples and in the Croneri commentary.

1.8. Accordingly, even though the UAE treats the foundation as tax-transparent for UAE corporate tax purposes, a UK tax analysis points to the conclusion that the foundation is opaque as regards both the founder and the UK-resident beneficiary. Ongoing profits are not attributed to them on an accrual basis merely by virtue of UAE transparency.

The GloBE Framework for Flow-through Entities

⒉ Under the Model GloBE Rules and UAE DMTT Rules, the UAE foundation qualifies as a Flow-through Entity to the extent it is fiscally transparent with respect to its income, expenditure, profit or loss in the jurisdiction where it was created. In line with Article 10.2.1 of the Model Rules,[9] such a Flow-through Entity is characterized, on an owner-by-owner basis, either as a Tax Transparent Entity or as a Reverse Hybrid Entity:

(a) it is a Tax Transparent Entity with respect to its income, expenditure, profit or loss to the extent that it is fiscally transparent in the jurisdiction in which the relevant owner is located; and

(b) it is a Reverse Hybrid Entity with respect to its income, expenditure, profit or loss to the extent that it is not fiscally transparent in the jurisdiction in which the relevant owner is located.

An Entity is treated as fiscally transparent under the laws of a jurisdiction if that jurisdiction treats the income, expenditure, profit or loss of that Entity as if it were derived or incurred by the direct owner in proportion to that owner’s interest (Article 10.2.2)[10].

In our case, the UAE foundation is therefore:

- a Tax Transparent Entity vis-à-vis the Spanish resident beneficiary (who is taxed on a look-through basis), and

a Reverse Hybrid Entity vis-à-vis the UK resident beneficiary (for whom the foundation is treated as an opaque vehicle).

⒊ Article 3.5.1(b)[11] lays down the basic allocation rule: “The Financial Accounting Net Income or Loss of a Constituent Entity that is a Flow-through Entity is allocated as follows: … in the case of a Tax Transparent Entity that is not the Ultimate Parent Entity, any Financial Accounting Net Income or Loss … is allocated to its Constituent Entity-owners in accordance with their Ownership Interests”. This rule shall be applied “separately with respect to each Ownership Interest in the Flow-through Entity” (Article 3.5.2).

In abstract, the Spanish beneficiary–UAE Foundation pair meets the definition of a Tax Transparent Entity relationship. However, in the present case the Foundation is the Ultimate Parent Entity. As such, Article 3.5.1(b) is not engaged and cannot be used to “push out” the Spanish beneficiary’s share of income from the GloBE perimeter.

This conclusion is reinforced by the status of the owners. The Foundation’s only stakeholders are individual beneficiaries, who are not Constituent Entities of any MNE Group. There are therefore no “Constituent Entity-owners” to whom Financial Accounting Net Income could be allocated under Article 3.5.1(b), and no Ownership Interests in the Flow-through Entity held by Constituent Entities to which Article 3.5.2 could attach.

⒋ Applied to the UK beneficiary–UAE Foundation pair, the Foundation is characterized as a Reverse Hybrid Entity to the extent that it is not fiscally transparent in the UK. In that case as well, Article 3.5.1(c) bites: any Financial Accounting Net Income or Loss in respect of income viewed as opaque in the UK is allocated back to the Foundation itself, rather than to the UK beneficiary.

⒌ Accordingly, for both the Spanish (Tax Transparent UPE) and UK (Reverse Hybrid) legs, Article 3.5.1(c) confirms that the entirety of the Foundation’s Financial Accounting Net Income remains with the Foundation for GloBE purposes.

⒍ Article 3.5.3 provides that “prior to the application of Article 3.5.1, the Financial Accounting Net Income or Loss of a Flow-through Entity shall be reduced by the amount allocable to its owners that are not Group Entities and that hold their Ownership Interest in the Flow-through Entity directly or through a Tax Transparent Structure”. However, such a reduction “does not apply to:

(a) an Ultimate Parent Entity that is a Flow-through Entity; or

(b) any Flow-through Entity owned by such an Ultimate Parent Entity (directly or through a Tax Transparent Structure)”.

Thus, although the beneficiaries of the UAE foundation are individuals and not Group Entities, the usual “reduction” mechanism for non-group owners does not apply, because the foundation itself is a Flow-through UPE. Its full Financial Accounting Net Income remains at its level for GloBE purposes.

Finally, Article 3.5.5 states that “the Financial Accounting Net Income or Loss of a Flow-through Entity is reduced by the amount that is allocated to another Constituent Entity”. In the present case, there is no other Constituent Entity (only individuals). Hence, Article 3.5.5 also leaves the foundation’s GloBE income untouched.

⒎ The upshot is straightforward but powerful: for GloBE purposes, the UAE foundation has GloBE Income of 100, notwithstanding the fact that, for domestic law purposes, Spain looks through to Beneficiary S, and the UK taxes Beneficiary U only on distributions/benefits.

Allocation of Covered Taxes under the GloBE Rules

⒏ The more delicate question is whether taxes borne by the Spanish and UK beneficiaries in their residence states can be “brought back” into the GloBE computation as Covered Taxes of the UAE foundation.

⒐ Article 4.3.2 governs inter-entity allocation of Covered Taxes. The relevant parts are:

b) the amount of any Covered Taxes included in the financial accounts of a Tax Transparent Entity with respect to GloBE Income or Loss allocated to a Constituent Entity-owner pursuant to Article 3.5.1(b) is allocated to that Constituent Entity-owner;

c) in the case of a Constituent Entity whose Constituent Entity-owners are subject to a Controlled Foreign Company Tax Regime, the amount of any Covered Taxes included in the financial accounts of its … Constituent Entity-owners under a Controlled Foreign Company Tax Regime on their share of the Controlled Foreign Company’s income are allocated to the Constituent Entity;

d) in the case of a Constituent Entity that is a Hybrid Entity the amount of any Covered Taxes included in the financial accounts of a Constituent Entity-owner on income of the Hybrid Entity is allocated to the Hybrid Entity”. In contrast to Reverse Hybrid Entity, which is “is fiscally transparent … in the jurisdiction where it was created …” but “not fiscally transparent in the jurisdiction in which the owner is located” (Art. 10.2.1)[1], a Hybrid Entity is “an Entity that is treated as a separate taxable person for income tax purposes in the jurisdiction where it is located … with respect to its income, expenditure, profit or loss to the extent that it is fiscally transparent in the jurisdiction in which its owner is located” (Art. 10.2.5).[2]

e) the amount of any Covered Taxes accrued in the financial accounts of a Constituent Entity’s direct Constituent Entity-owners on distributions from the Constituent Entity during the Fiscal Year are allocated to the distributing Constituent Entity”.

At a purely textual level, sub-paragraph (b) might appear relevant to the Spanish beneficiary–UAE Foundation leg, to the extent Spain treats the Foundation as tax transparent and taxes the beneficiary on an accrued share of the income. Likewise, sub-paragraphs (c) (CFC tax at owner level) and (e) (taxes on distributions) might seem, in abstract, to offer a route to allocate UK personal taxes on the Foundation’s profits or distributions back to the Foundation in the UK beneficiary–UAE Foundation leg. By contrast, sub-paragraph (d) cannot apply on the facts, as there is no Hybrid Entity in play: the Foundation is not treated as a separate taxable person in the UAE while being fiscally transparent in the owner’s jurisdiction.

However, three structural features of the present fact pattern prevent any of these mechanisms from operating in practice:

- All of the allocation rules in Article 4.4.2(b)–(e) presuppose that the relevant tax is a Covered Tax of a “Constituent Entity-owner”, i.e. a tax actually recognised in the financial accounts of another Constituent Entity within the MNE Group.

- In the present case, both beneficiaries of the Foundation are individuals, and their personal income taxes in Spain and the UK are not taxes of any Constituent Entity, nor are they reflected in the consolidated financial statements of the Group. They therefore fall outside the notion of Covered Taxes of a Constituent Entity-owner that can be reallocated under Article 4.4.2.

- Moreover, the Foundation is an ownerless legal person in civil-law terms: no person holds a proprietary or equity interest in the Foundation itself. The beneficiaries have only personal and economic rights (principally to receive benefits), but no equity- or membership-type interest that would qualify them as “Constituent Entity-owners” for GloBE purposes. In substance, there is no Constituent Entity-owner to which Article 4.4.2(b)–(e) could attach.

As a result, even where the wording of Article 4.4.2(b), (c) or (e) might appear partially pertinent when viewed in isolation, none of these provisions can be used to bring the Spanish or UK beneficiaries’ personal taxes into the Foundation’s Covered Taxes for GloBE purposes.

⒑ Article 4.3.3 introduces a cap on taxes allocated under the CFC and Hybrid Entity rules in respect of Passive Income, limiting the amount of such allocated taxes that can be taken into Adjusted Covered Taxes. But this limitation is never reached here: there is no qualifying allocation in the first place, because the taxes in question are not borne by any Constituent Entity.

Synthesis and Implications

⒒ This case study illustrates a potentially counter-intuitive, but structurally coherent, feature of the GloBE architecture. Spain’s “new” look-through approach and the UAE’s transparent classification of the foundation produce full domestic transparency for Beneficiary S: the Spanish resident is taxed currently on an accrued share of the underlying income. By contrast, the UK’s classification is characteristically opaque, with taxation focused on distributions and anti-avoidance attribution for Beneficiary U. Yet, the GloBE Rules treat the UAE foundation itself as the locus of GloBE Income in both cases, precisely because it is a Flow-through UPE and its stakeholders are individuals rather than Constituent Entities.

11.1. Irrelevance of personal taxes for GloBE ETR.

The personal tax burdens in Spain and the UK lie entirely outside the GloBE framework. They do not qualify as “Covered Taxes of a Constituent Entity” and are not recorded in the consolidated financial statements of any MNE Group. The allocation rules in Article 4.4.2 are calibrated to move taxes between Constituent Entities (for example, between a CFC and its corporate shareholder), not between individuals and entities. As a result, personal income taxes borne by Beneficiary S in Spain and Beneficiary U in the UK cannot enter into the computation of the foundation’s Adjusted Covered Taxes.

11.2. Asymmetric relief: tax recognised nowhere for GloBE purposes.

The structure can therefore produce an asymmetric outcome. Significant personal-level taxation may be levied on the same economic profits in the residence jurisdictions of the individual beneficiaries, but none of that tax is creditable in the GloBE effective tax rate for the UAE foundation. This may lead to a comparatively low jurisdictional ETR for the UAE, and thus potential Top-up Tax under the DMTT, even though the ultimate human owners are already highly taxed in Spain or the UK.

11.3. Planning and policy implications.

For structures involving transparent UAE vehicles (foundations, partnerships) with individual participants, particularly where those participants reside in jurisdictions such as Spain (which may fully respect foreign transparency) and the UK (which typically does not), corporations and their advisers must carefully distinguish between:

- the domestic classification and taxation of the entity and its income in each jurisdiction; and

- the GloBE classification and allocation, which, in the present fact pattern, is largely indifferent to those domestic variations and focuses on the UAE foundation as a Flow-through UPE with GloBE Income of 100.

This separation is essential both for technical modelling of the DMTT exposure and for policy discussions on whether the Pillar Two framework sufficiently accounts for personal-level taxation of ultimate individual owners.

[1] Art. 87 Ley 35/2006, de 28 de noviembre, del Impuesto sobre la Renta de las Personas Físicas y de modificación parcial de las leyes de los Impuestos sobre Sociedades, sobre la Renta de no Residentes y sobre el Patrimonio (LIRPF), BOE núm. 285, 29 noviembre 2006 (BOE-A-2006-20764).

[2] Art. 6 Ley 27/2014, de 27 de noviembre, del Impuesto sobre Sociedades (LIS), BOE núm. 288, 28 noviembre 2014 (BOE-A-2014-12328).

[3] Art. 37 Real Decreto Legislativo 5/2004, de 5 de marzo, por el que se aprueba el texto refundido de la Ley del Impuesto sobre la Renta de no Residentes (TRLIRNR), BOE núm. 62, 12 marzo 2004 (BOE-A-2004-4527).

[4] Resolución de 6 de febrero de 2020, de la Dirección General de Tributos, sobre la consideración como entidades en régimen de atribución de rentas a determinadas entidades constituidas en el extranjero, BOE núm. 38, 13 febrero 2020 (BOE-A-2020-2108), apdos. II–V.

[5] Joint Declaration by the Government of the Principality of Liechtenstein and Her Majesty’s Revenue & Customs concerning cooperation in tax matters (Appendix A: Guidance on characterization, recognition and treatment of Liechtenstein legal entities and fiduciary relationships), signed 11 August 2009, available via link.

[6] Andrew Parkes, “Can You Trust The Foundations?”, IFC Review (2024), available via available via link.

[7] Judgement of the DIFC Court of Appeal № CA 002/2020 of 18 January 2021, para 102.

[8] Dominic Lawrance & Jonathan Rothwell, “Offshore trusts: Have reports of their demise been greatly exaggerated?”, Charles Russell Speechlys, 7 July 2025, available via link.

[9] Mirrored in Article 18.2.1 of the UAE DMTT rules annexed to Cabinet Decision No. 142 of 31 December 2024.

[10] Mirrored in Article 18.2.2 of the UAE DMTT rules annexed to Cabinet Decision No. 142 of 31 December 2024.

[11] Here and below, unless otherwise specified, references are to the Articles of the GloBE Model Rules. Any Article number cited corresponds to the same Article number in the UAE DMTT Rules where the provision is mirrored. If the numbering does not coincide, this will be specifically indicated.

[12] Article 18.2.1 in the UAE DMTT Rules.

[13] Article 18.2.5 in the UAE DMTT Rules.

The disclaimer

Pursuant to the MoF’s press-release issued on 19 May 2023 “a number of posts circulating on social media and other platforms that are issued by private parties, contain inaccurate and unreliable interpretations and analyses of Corporate Tax”.

The Ministry issued a reminder that official sources of information on Federal Taxes in the UAE are the MoF and FTA only. Therefore, analyses that are not based on official publications by the MoF and FTA, or have not been commissioned by them, are unreliable and may contain misleading interpretations of the law. See the full press release here.

You should factor this in when dealing with this article as well. It is not commissioned by the MoF or FTA. The interpretation, conclusions, proposals, surmises, guesswork, etc., it comprises have the status of the author’s opinion only. Furthermore, it is not legal or tax advice. Like any human job, it may contain inaccuracies and mistakes that we have tried my best to avoid. If you find any inaccuracies or errors, please let us know so that we can make corrections.